The global electronic products market is experiencing an unprecedented supply chain shock. Driven by the extreme demand for computing infrastructure from the artificial intelligence (AI) boom, the price of storage chips, a core component of electronic devices, has completely deviated from the normal market track and entered a period of crazy surge. This price hike is truly affecting every consumer’s choice of electronic devices.

For global tech giants such as Apple, Samsung, Dell, and Xiaomi, 2026 is no longer a golden period for the release of technological dividends, but a tough tug-of-war over survival costs — the runaway price of storage chips is reshaping the cost logic and competitive landscape of the entire electronics industry.

01 The “Storage Black Hole” Behind the AI Boom: Core Causes of the 7x Price Surge

Storage chips are mainly divided into two categories: DRAM (Dynamic Random Access Memory), which is responsible for real-time task processing of devices and is the key to the smooth operation of devices; and NAND flash memory, which is responsible for long-term data storage and determines the storage space of mobile phones and computers. Over the past decade, such components have been regarded as standardized commodities, with prices fluctuating regularly according to the production capacity cycle, predictable and controllable. However, this stable logic has been completely broken since the beginning of last year, with the core reasons focusing on two points:

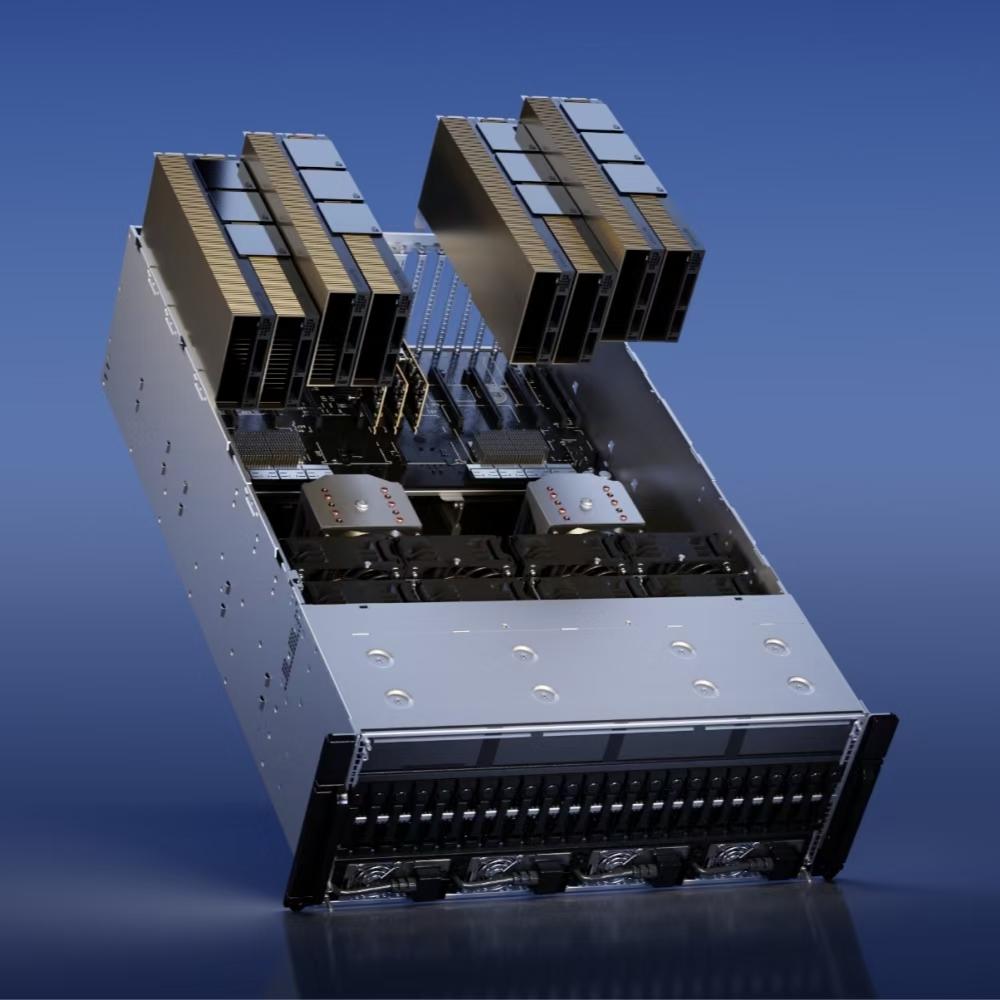

First, the “siphon effect” of computing power demand is prominent. The explosive growth of generative AI requires massive data centers to provide computing power support, and the demand for high-performance storage chips by AI servers is several times that of traditional servers. The massive demand for computing power is like a huge “storage black hole”, frantically absorbing the production capacity of storage chips in the market and directly breaking the supply-demand balance.

Second, production capacity mismatch exacerbates supply shortages. Major global storage giants such as Samsung, SK Hynix, and Micron have prioritized allocating their limited production capacity to higher-margin AI-specific storage (such as HBM), leading to a significant contraction in the production capacity of DRAM and NAND flash memory for the consumer market, which ultimately fell into a dilemma of supply exhaustion.

Data is the most convincing: in the past 12 months, the contract prices of DRAM and NAND flash memory have soared to about 7 times their original levels. Such an increase is extremely rare in the history of the semiconductor industry, like a “cost tsunami”, which has directly led to the complete collapse of the cost structure of downstream hardware manufacturers, forcing them to find a way out.

02 Hardware Manufacturers’ “Survival Choice of Three”: Price Hike, Configuration Shrinkage, or Profit Concession?

Faced with the rigid cost pressure brought by the skyrocketing price of storage chips, global electronic giants have no choice but to make difficult trade-offs among three high-risk options, and each choice will eventually be passed on to consumers.

The first is to directly pass on the price to the consumer side. Dell has taken the lead in raising prices, increasing the price of some commercial laptops by up to 30%. Dell’s Chief Operating Officer stated bluntly that the cost pressure on the supply chain has reached a critical point, and the pressure can only be transferred to customers through price hikes. Similarly, Xiaomi Group also clearly stated that the price increase of smartphones has become an “imminent and long-term trend”, and consumers may have to spend more money to buy mobile phones in the future.

The second is to quietly downgrade product configurations, which is a disguised “shrinkage”. To control costs and maintain price competitiveness, many manufacturers choose to “cut corners” on configurations: some entry-level personal computers of Acer have quietly reduced RAM; Xiaomi’s new flagship model 17 Ultra has even discontinued the 256GB version, only offering versions with higher capacity and higher prices. The starting price has increased by about 70 US dollars compared with the previous generation, which is equivalent to consumers being forced to “pay” for higher capacity, but in fact, the choice of configurations has been reduced.

The third is to accept the inevitable decline in profits. Even a giant like Apple cannot avoid this profit pain. Apple CEO Tim Cook said that although the company’s inventory could barely buffer the cost pressure before, starting from this fiscal quarter, the surge in storage chip prices will have a more significant impact on the company’s gross profit margin. For small and medium-sized mobile phone brands with already narrow profit margins, the “low price and high configuration” core competitiveness they relied on in the past has basically declared bankruptcy in 2026, and the survival pressure has increased sharply.

03 Quantitative Analysis: Soaring Storage Cost Ratio Pushes Various Devices to the “Cost Warning Line”

According to the latest data analysis from IDC and Counterpoint, the runaway price of storage chips has pushed the cost of various electronic devices to the “warning line”. Different types of devices face significantly different cost pressures, but all are facing severe challenges:

In the budget mobile phone market, the proportion of storage costs is as high as 35%, making it one of the components with the highest cost proportion. This has forced many small and medium-sized manufacturers to abandon the low-end market and turn to the high-end market to cover costs through higher profit margins; the PC industry is also severely affected, with the proportion of storage costs rising to 20%-30%, directly leading to large fluctuations in computer prices and suppressing consumers’ replacement demand — many people choose to continue using their old computers instead of buying new ones at higher prices.

Even for high-end flagship models such as the iPhone 17 Pro Max, storage costs account for more than 20% of the total device cost. To cover up the substantial price increase, Apple may increase the starting storage capacity to make consumers feel that the “cost performance has not changed”, but in fact, it has indirectly raised the threshold for purchasing phones; at the same time, the game console industry, where storage costs account for 20%, is facing the dilemma of increasing hardware losses and forced extension of product life cycles; while the TV industry, where storage costs account for only 7%, due to its meager profits, giants such as LG hold a pessimistic attitude towards the market prospect this year, stating that the cost pressure is difficult to digest.

04 Industry Chain Reaction: Declining Demand and Shrinking Shipments, the Electronics Industry Falls into a Dilemma

The surge in storage chip prices has not only restructured the cost structure of electronic manufacturers but also shaken the foundation of the entire electronics industry’s recovery. The unprecedented price surge has directly suppressed the overall demand in the PC and smartphone industries, forming a vicious circle of “price hike → reduced demand → shrinking shipments”.

Although most manufacturers hope to offset the impact of declining sales by promoting high-end products through higher unit profits, the overall market sentiment has been severely hit. IDC’s pessimistic forecast shows that global mobile phone shipments are expected to decline by 5.2% in 2026, and global PC shipments are expected to decline by 8.9%, pushing the entire consumer electronics industry into a downturn.

What’s more tricky is that the timing of this “storage shortage” is extremely awkward. At present, the global tech industry is fully promoting the development of “on-device AI” — that is, allowing AI models to run directly on terminal devices such as mobile phones and computers. The efficient operation of on-device AI precisely requires larger and faster storage capacity as support. On the one hand, the skyrocketing storage prices force manufacturers to downgrade configurations; on the other hand, technological evolution requires upgrading configurations. This serious mismatch is putting the consumer electronics industry in a dilemma, making the road to recovery increasingly difficult.

05 Conclusion: A Long “Supply Winter” Until 2028

Due to the continued boom in global AI infrastructure investment, the tight supply situation of storage chips is expected to last until the end of 2028. This means that in the next two to three years, resources will continue to tilt towards the AI field, and ordinary consumers’ electronic devices are paying a heavy premium for this global computing power race.

For each of us, in the next period of time, we may see more “shrunk” entry-level electronic devices — with reduced configurations and fewer choices; while the prices of high-end flagship models will continue to break through the ceiling and become more and more expensive. This storage storm triggered by AI is profoundly changing our consumption habits and reshaping the future pattern of the entire electronics industry.