“I’ve been selling memory modules for over a decade, and I’ve never seen a market like this—it’s like the real estate speculation boom back in the day! A module that cost $145 (1,000 RMB) in the first half of last year now sells for over $723 (5,000 RMB), and it’s still rising every day.” A shop owner at Shenzhen’s Huaqiang Electronics World told a reporter from the Securities Times. Since the second half of 2025, the memory market has entered a new “super bull market” cycle, with prices of various memory modules generally more than tripling, now surpassing the historical high of 2018.

However, regarding the recent claim that “a box of memory modules can be exchanged for an apartment in Shanghai,” several Huaqiangbei merchants dismissed it as “mostly a gimmick.” They revealed that 256GB DDR5 server memory modules, priced at over $5,786 (40,000 RMB) per unit, are mainly purchased in bulk through bidding by enterprises, research institutions, and government agencies, and rarely circulate in the consumer market. Mainstream memory modules for mobile phones and computers are gradually entering the “$145 (1,000 RMB) price range.”

From 2016 to 2018, driven by strong smartphone sales and booming gaming demand, memory prices also surged due to insufficient production capacity at manufacturers like Micron and Samsung. But merchants noted that the current rally is far more intense—with the price increase in just six months matching the three-year gain back then. According to a report from market research firm Counterpoint Research, storage chip prices soared 40% to 50% in the fourth quarter of 2025, and are expected to rise another 40% to 50% in the first quarter of 2026, followed by a 20% increase in the second quarter.

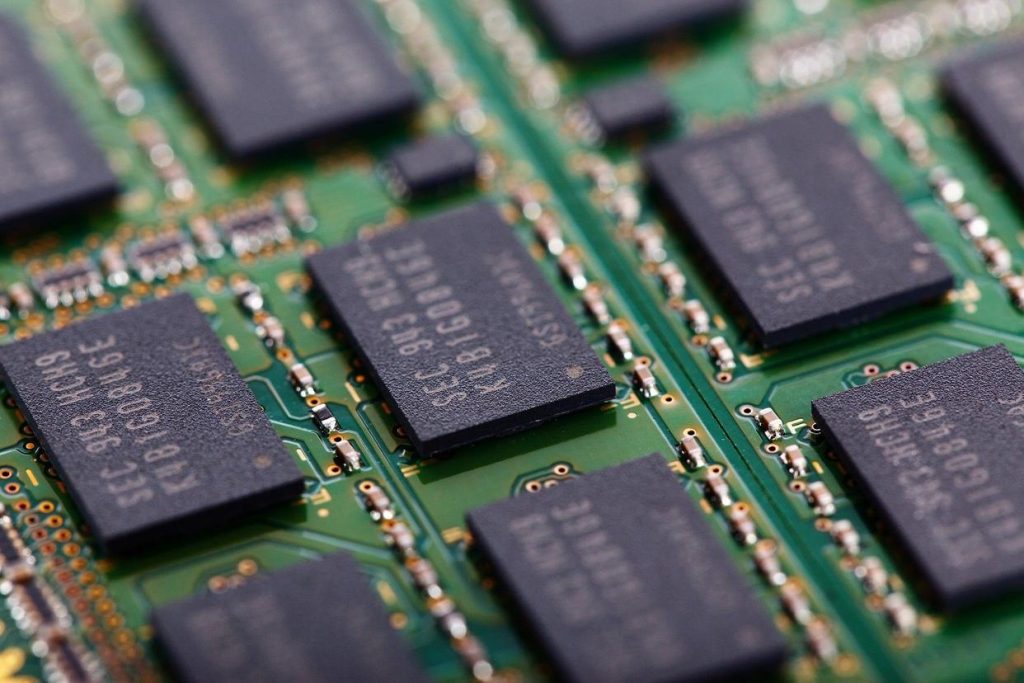

Frenzy: “Black Gold Bars” Hit New Highs Daily, High-End Products Lead Gains

Today, memory modules have become veritable “black gold bars” in Huaqiangbei. At a computer assembly counter on the fourth floor of SEG Electronics Building, Boss Yang held up a 32GB Acer Predator DDR5 memory module with a frequency of 6000MHz and said: “It sold for around $102 (700 RMB) six months ago; now it’s over $361 (2,500 RMB), and the price changes every day.”

Most memory modules sold by Huaqiangbei merchants are consumer-grade DDR4 and DDR5 products, with varying price increases depending on brand, capacity, and frequency. Boss Li, also based in SEG Electronics Building, pointed to a Kingston module and said: “Even the least expensive models have at least doubled in price. This one used to cost around $43 (300 RMB); now it sells for over $87 (600 RMB).” Currently, price increases for DDR4 and DDR5 modules in Huaqiangbei generally range from 100% to 300%, with higher-end products typically seeing steeper gains.

“The price isn’t rising non-stop. The most intense period was last September to October, when prices of various modules jumped about 40%—the main products I sell increased by an average of $14.5 (100 RMB) per day. Since then, prices have fluctuated at high levels, changing almost daily, and they’ve hit new highs again these past few days,” Boss Li added. As a cyclical product, memory price fluctuations are common for merchants, but the magnitude and speed of the current surge have left even long-time Huaqiangbei bosses stunned.

The core driver behind the price spike is the “super bull market” for storage chips—the key component of memory modules. Counterpoint Research’s report confirms this trend: storage chip prices surged 40% to 50% in Q4 2025, are projected to rise another 40% to 50% in Q1 2026, and a further 20% in Q2, continuing to fuel memory price increases.

Anxiety: Plunging Sales Leave Most Merchants’ Profits Barely Flat

Despite the “rocket-like” price increases, Huaqiangbei merchants are generally “torn between joy and worry”: while higher prices bring fatter margins per order, plummeting sales have become a harsh reality.

Journalists’ on-site visits highlight the stark market shift: in the morning of November 2025, most shops selling memory modules or offering computer assembly services in Huaqiang Electronics World were open for business; but during the same time period on January 8, 2026, some of these shops remained closed, only opening in the afternoon. Boss Wu, who sells memory modules on the same floor, revealed: “Some peers have seen their sales drop by over 90%—times are tough.”

“Memory prices have skyrocketed so much that non-essential individual consumers are holding off on buying computer accessories. The price hike has had a huge impact on our order volume,” Boss Wu lamented. However, despite the sharp drop in foot traffic, many dedicated memory sellers have managed to keep profits roughly the same thanks to higher margins. Boss Wu explained: “We used to have a profit margin of less than 5% on memory modules; during this price surge, we’ve raised it to 5% to 10%. Combined with the overall price increase, our total profits haven’t changed much.”

Reporters learned that a small number of astute merchants stocked up in advance and held onto inventory, reaping huge profits from the price surge. But most merchants said they never anticipated such a sustained rally, operating on a “buy-as-you-sell” basis and only capturing a portion of the price difference.

Computer assembly shops are faring even worse. A merchant at SEG Electronics Building admitted: “We don’t just sell memory—we also offer graphics cards, CPUs, and other accessories. Since memory prices spiked, demand for custom-built computers has plummeted; we barely get any orders all day. If this continues for another year or two, I’ll have to consider switching businesses.”

Overall, aside from a handful of merchants with sharp business acumen, most Huaqiangbei sellers feel anxious amid this “super bull market”: unsure how long the price hikes will last, they are more cautious about restocking and struggling to make sales.

Impact: Bull Market May Extend to H2 2026, Pressuring Downstream Industries

Why have memory prices surged so dramatically? Boss Yang cited the core reason: “AI servers have siphoned off production capacity from storage chip manufacturers. Samsung, Micron, and SK Hynix have all shifted capacity to high-end storage for AI servers, leading to insufficient supply for consumer-facing mobile and computer products—hence the price hikes.”

Xu Jiayuan, an analyst at TrendForce, confirmed this view. He noted that AI-driven demand is concentrated on HBM, high-capacity DDR5 RDIMM, and LPDDR5X products for AI Server applications. Unlike previous industry cycles, AI-driven cycles require longer lead times for capacity expansion, and only major storage manufacturers can supply these products. In 2026, the three leading storage chip makers are expected to rapidly upgrade production capacity to advanced processes, vying for market share in these three product categories—especially among high-demand North American cloud service providers—while continuing to reduce the proportion of mature process capacity.

This means consumer-facing DDR4 and DDR5 memory products will remain in tight supply, with prices likely to keep rising in the short term. Xu Jiayuan predicted that DRAM contract prices for various applications will rise by more than 15% in Q1 2026, with growth moderating in Q2 but the uptrend possibly extending into H2 2026.

The ripple effects of rising memory prices are already hitting multiple downstream markets. Li Bin, founder, chairman, and CEO of NIO, stated at a media briefing that the biggest cost pressure for the automotive industry in 2025 does not come from raw materials (whose price increases have not yet been passed on to end consumers and remain manageable), but from memory—with the automotive sector competing with AI, computing centers, mobile phones, and other industries for memory components.

Ivan Lam, senior analyst at Counterpoint Research, pointed out that the impact of rising memory prices is likely to spread across the entire smartphone and consumer electronics ecosystem, leading to a significant increase in smartphone BOM (Bill of Materials) costs—with some models potentially seeing price hikes of up to 15%. This will directly affect the mid-to-high-end smartphone market, further squeezing profit margins for related enterprises.